Are you looking for the best way to improve your credit score fast?

Check out our guide as we look at the top ways to improve and fix your credit score today.

Do you know that only about 1.6% of consumers in the U.S. have a good credit score?

Having a good credit score is essential in taking a mortgage, student loan, or auto loan, but it can also determine the interest rate. Unfortunately, it takes time to have the best credit score. So read on to find out seven ways to fix your credit score.

1. Check and Monitor Your Credit

Before we plan how to improve our credit score, we need to check if the credit score is correct. A credit report can be obtained from the Federal Trade Commission’s website, and everyone is entitled to request a free copy.

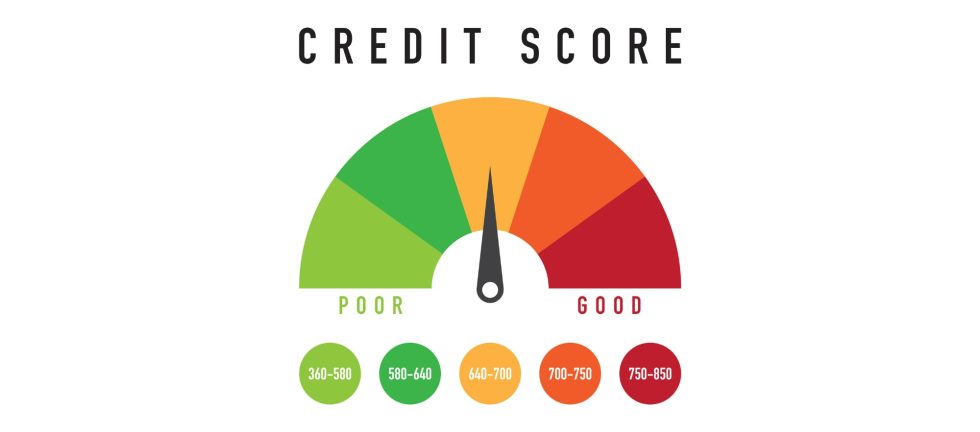

The credit report illustrates our credit performance, so it is important that the credit score is accurate. A credit score range is between 300—to 850, with 700 being ‘good’.

Once we confirm that there are no mistakes with our current credit score, we can get into a habit of monitoring it. Credit score fluctuates, so checking for any variations can help maintain your credit score and look for ways to improve it.

2. Pay Off Your Debts

Our credit score range will depend on outstanding debts and loans we have. To raise your credit score, pay them off as soon as possible.

If a debt or a loan is outstanding, it has been left for too long. Of course, some loans, like mortgages or student loans, may be impossible to pay quickly. However, the sooner they are paid off, the sooner you reach the best credit score.

We may be putting money into our savings accounts, which is a good practice. However, this will not help us much if we have outstanding debts and loans. Interest rates on loans, or credit cards, are usually higher than on savings accounts.

3. Pay Bills on Time

It may seem straightforward, but paying all bills on time can improve a credit score. It will not only help us to avoid paying any additional charges for missing the due day, but also build a good track record.

Lenders want to see that we have the financial means to pay off our loans and that we are punctual with our payments. If we miss paying a bill on time once, it may not impact our credit score. But if this happens consistently, a credit score will go down.

To help with making payments on time, consider setting up automatic bill pay.

4. Keep Your Old Accounts Open

Paying off a student loan, mortgage, or auto loan can be very satisfying. The first thing we may want to do once we paid them off, is to close the accounts.

However, having paid-off accounts, including credit card accounts, are a good thing for credit score. If we paid our repayments on time and managed to pay the loan off, we show that we are responsible.

Creditors are looking for a solid track record, and a paid-off loan is proof they need. In addition, keeping credit card accounts open can help with the debt-to-credit ratio. Lenders look not at how much credit we have but at how much credit we used.

It is worth noting that debts are automatically removed over time. Late payments, collections, or foreclosures can stay up to seven years, while bankruptcies can for almost ten years.

5. Apply for Credit You Only Need

It may be tempting to get a new line of credit each time we need it. When we do that, our credit score lowers. It applies even when we submit an application to check if we get approved.

Of course, when we need a loan applying for credit can be our only option. However, if we do it often, this signals that we may be taking on more debt than we can financially handle.

What may help in maintaining your credit score is doing research and assessing if you are a good candidate for a loan. Many online tools can help to check our lending abilities. If we expect our application to be denied, it is better to get pre-approval or pre-qualification because those are soft credit pulls.

Good financial planning and budgeting can help to save up enough money and prevent us from taking the loan in the first place. Even services such as Buy Now Pay Later can lower a credit score.

And when we are on the subject of credit, keep your credit card balance low. Apply only for the amount you need to cover the expense.

6. Build Your Credit Score

Maintaining your credit score is a long-term process. It takes patience, perseverance, and healthy credit habits. Paying bills on time, applying for credit only when needed, and keeping the debit-to-credit ratio in check are all examples of how to increase a credit score.

Two elements that can help with a credit score are the average age of accounts and the number of accounts. So, having a loan that we are paying off may help us. However, this can be a disadvantage if our credit history is limited.

There are programs that can boost our credit score with other financial statements, such as adding our utility payment history. Or our checking and savings accounts can be included in scoring our credit.

7. Get Professional Help

It may still be hard to raise your credit score on your own. That is where hiring a professional service can be a game changer. services such as Hire a hacker to fix credit score can guide us in changing our credit scores.

We can help fix your credit score by accessing any errors or mistakes on your credit score statement. We can keep your information safe and liaise with many rating agencies.

Fix Your Credit Score Now

It doesn’t take long to lower a credit score but improving it can be a challenging process. To fix your credit score, you should monitor spending, pay bills on time and develop healthy credit habits.

Hiring a professional agency is a great solution, too. So, contact us today to see how we can help to increase your credit score!